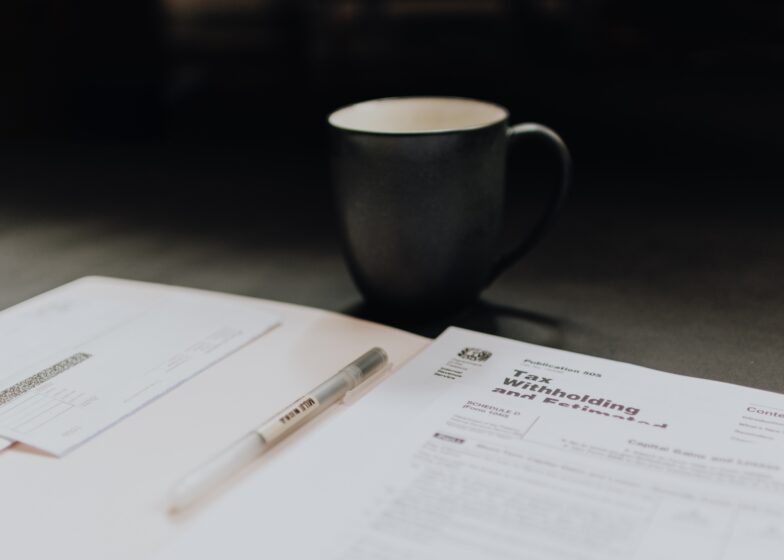

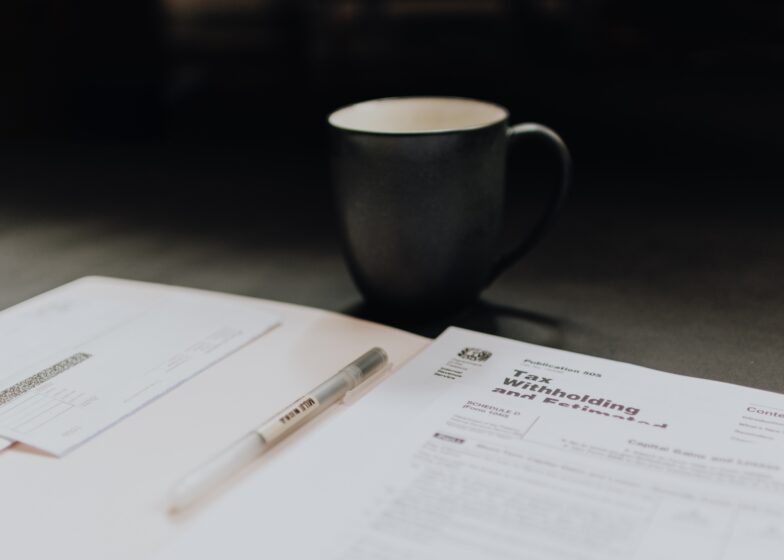

It’s Not What You Make, It’s What You Keep

There’s an old adage, “It’s not what you make, it’s what you keep.” Tax filing season serves as an annual reminder of this concept. If you make $2 million but have to pay 50% to Uncle Sam and your state, it doesn’t feel like you’ve actually made $2 million, does it? That’s why I would…

Go Bag

In college, one of our favorite pastimes was giving each other wild scenarios and asking what everyone would pack in their ‘Go Bag’ given the circumstances. The answers were always shocking and intentionally goofy, but it was clear that none of us had a true understanding of what and when a ‘Go Bag’ was used….

Private Foundations vs. Donor-Advised Funds

By: Alex Weiss CFP® | President & Wealth Manager As we enter the new year, some of our clients are looking ahead at significant income events such as selling a business. Whatever the cause, the expected income comes with a hefty tax bill if no creative action is taken. Two common charitable giving options often…

My Ideal Annual Review

By John P. Napolitano CFP®, CPA, PFS, MST | Founder & Chairman I was recently asked, “John, what does your ideal annual review look like? What are you looking at for yourself?” Everyone’s financial situation evolves as life goes on. We go through various stages: accumulation, spending, preservation, and distribution. At this stage of my…

Family Traditions

We are lucky to have family traditions that my kids, as young as they are, anticipate with excitement and energy only young children can bring. With the holidays upon us everyone has traditions on their mind, and when you have a new generation of children the traditions of old often get a little shaken up. …

Gifts That Keep On Giving

By John P. Napolitano CFP®, CPA, PFS, MST | Founder & Chairman We’re a week from the holidays, and hopefully, your holiday shopping is mostly done. Few things are less fun than joining the crowd of stressed procrastinators looking for last-minute presents this week. And can we even trust that 2-day delivery online shopping promises…

From Secret Agents to Secret Ingredients

The CIA is an entity of great respect and secrecy. America’s top minds spend their days hard at work, homing in their craft for the benefit of our nation’s peace of mind, united pride and ……. full bellies? Yes, the Culinary Institute of America is the premier training grounds of our country’s best chefs. Over…

How Alex Met John

By John P. Napolitano CFP®, CPA, PFS, MST | Founder & Chairman There’s a lot I’m grateful for in life. One thing I am uniquely grateful for is the incredible multi-generational team we’ve been able to build at Napier Financial. When you spend a few decades giving 100% effort on behalf of your clients, it…

2024: Milestones, Memories, and What’s Next

This may well be my last article of 2024. To that end, I’d like to be the first to say that spending 2024 with you has been a privilege. I know the year wasn’t a privilege for everyone. 2024 brought its share of heartbreaks to the 135 families that we work with. And for you,…

Giving Through Endowments

By John P. Napolitano CFP®, CPA, PFS, MST | Founder & Chairman In honor of Giving Tuesday Financial planning is at its best when a client asks us, “Help me find a way to do something that’s deeply important to me.” In that vein, I want to share a recent client story of this sort…

From Our Table to Yours

We asked our team to share their favorite dishes that make Thanksgiving with loved ones extra special! What is your favorite dish to make or eat? Reply and let us know! Alex: So many great choices here, and this changes with time. However, my wonderful wife Ashley makes this butternut squash soup for a first…

The Perfect Bite

As we approach one of my favorite times of the year, Thanksgiving, into the holiday season, I constantly have flash back memories of those holiday traditions as a kid. Depending on what house and what holiday, we had the ‘kids’ table all the way through being young adults. The conversations and the food seemed to…

Picking The Winners

By Rob Napolitano When you’re in the world of alternatives, you get asked a lot about who the “winners” are. The first thing I tell people is that the right question is more focused on what your financial objectives are, not who makes headlines for ROI. Alternatives can tiptoe between asset and liability when they’re…

Market Update: November 2024

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Legal counsel should be consulted for specific advice or recommendations about any individual’s personal legal circumstances. Investment and financial planning advice offered through US Financial Advisors, a Registered Investment Advisor.

Weekend in Wolfeboro!

This weekend Jenna and I were lucky enough to spend a few days in Wolfeboro, NH at her family’s lake house on Lake Winnipesaukee. It has been in the family for 50 years, and it is her favorite place on earth. Having spent countless weekends here with her family, cousins, aunts and uncles, her grandparents,…

Are Parents the Problem?

By John Napolitano CFP®, CPA, PFS, MST | Founder & Chairman When we think of multi-generational planning, most minds shift to children and grandchildren as the inheritors. However, most of the problems in estate planning belong to the parents. When passing the financial baton, it’s the parents’ responsibility first and foremost to set their families…

Halloween on the Hill

Years ago when we moved to the Beacon Hill neighborhood of Boston, we were told Halloween would be a mob scene, and we could perhaps expect hundreds of trick or treaters ringing our doorbell looking for loot. Stocking up on mass quantities of candy, we felt prepared for the oncoming onslaught- only to discover all…

Fully Integrated vs. Comprehensive Planning

By: Thomas Schulte | Director of Financial Planning A lot of people come to us familiar with the term “comprehensive financial planning.” They might say, “I’m working with a comprehensive financial planner right now.” However, we use the term “fully integrated financial planning.” The best and worst part about fully integrated financial plans is…

Trick or Treat

Halloween is creeping up on us, and while we’re busy crunching numbers, we can’t resist the allure of candy! Here’s what our team loves to indulge in when the office gets a little spooky. Alex: Peanut M&Ms for the win! That said, this might be the hardest article to write – anything with a combination…

How Are You Using 168 Hours?

By: John P. Napolitano | Founder and Chairman I think quality of life might be the best measure of success when it comes to financial planning. As much as most of us love winning the money game, what is money worth? What good is it if we don’t enjoy it? We meet phenomenally wealthy people…

Allow me a moment to put my Jane Austen hat on….

Nearly eleven years ago to this day, a gangly boy from Syracuse met a beautiful girl from Los Angeles by an odd stroke of luck, as they both went to the wrong hotel upon orientation of a study abroad program in Sevilla, Spain. Without much dating experience, he asked her to dinner that very same…

Do I Trust My Trustee?

By: Alex Weiss CFP® | President & Wealth Manager One of the fundamental rules of wealth preservation is to avoid the biggest mistakes. To be more specific, we sometimes refer to these as single points of failure in a financial plan. For high-net-worth families, designating your trustees might be one of the most often overlooked…

From Couch to Cleats

As I get older, I’m finding I need to schedule time with my friends further and further out, especially with there being 10 of us in widely varying careers and schedules. With the arrival of chilly fall weather here in MA, everyone’s instinct to begin hunkering down has kicked in and I thought it would…

Winning the Year-End Tax Game

By: John P. Napolitano | Founder and Chairman Before I got into financial advice, I was a CPA for a long time. I still carry the license. The reason I crossed the aisle was while taxes are complicated, it’s not that difficult to tell people what happened last year. Worse, I got tired of telling…

Look out, here comes Jim Cantore

In SW Florida, seeing Jim Cantore in person isn’t always a welcome sight. While many of us self professed weather geeks love watching him and all of the other natural wonders showcased on The Weather Channel, when he shows up in your town you know you’re in for a rough time ahead. Jim is now…

Market Update: October 2024

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Legal counsel should be consulted for specific advice or recommendations about any individual’s personal legal circumstances. Investment and financial planning advice offered through US Financial Advisors, a Registered Investment Advisor.

How Alternative Investments Fit Into Estate Plans

By Alex Weiss CFP® | President & Wealth Advisor Alternative investments can create friction in the conversation about estate planning. When someone is looking to fund their estate plan, we need to consider how tax liabilities will be funded. Now take alternative investments like privately held businesses, and you encounter a number of variables that…

Bring Me Bach

It is a joyous time of year as the crisp fall weather encroaches on New England. Windows down in the car as we try and skip around to find the songs that match our mood. For those who didn’t know, I have quite a few musical bones in my body. My mother went to Boston…

Integrated Decisions: Merging Business and Personal Finances

Do you know the #1 reason small businesses eventually fail? Up to 82% of failures directly result from owner-related cash flow problems. When you drill down into this group, a common trend emerges. It reads like this: Owner invests in growth, despite risk. Risk turns out to be riskier than thought. The owner’s personal finances…

Hollywood Hank

Henry Wolfe Napolitano joined us on July 25 at 7:52 AM. Ellie, Jack, Grayson, Jenna and I all adore him. It has been a pretty big adjustment, but we are all doing well. I should start by saying that we call him Henry, and Jenna will be disappointed by the title of this article, but…

Opening Financial Conversations with Aging Parents

When it comes to discussing finances with aging parents, it’s often a child, niece, or nephew who broaches the topic. This person is usually comparatively successful, organized, or deeply concerned. More often than not, they also witnessed estate planning or long-term care play out poorly in someone else’s life. Now, their parents are starting to…

The Neighbor I Hardly Knew

In this day and age of families sprawling around the country as children complete their education and begin their careers, it becomes increasingly more significant to know your neighbors. But in this case, I’m talking a bit more globally. For those who have travelled afar, you probably got the feeling from your international hosts that…

Using Roth IRAs to Teach Financial Literacy

It’s no secret that Roth IRAs are one of the best, if not the best, financial vehicles for young savers to start saving in. The earlier you begin, the more time you have for tax-free compounding. That’s only magnified when our kids or grandkids can begin saving as early as their teenage years. We have…

Adjusting to Life Post-Income

You might be surprised how often wealthy families experience anxiety when they exit their businesses or careers. It centers around a shift away from income to living off of assets. We have clients who have been earning an income since they were 14 working a paper route. Looking forward to the next paycheck is all…

Summer Rewind

As we rolled through the unofficial last days of summer, we looked around each morning and saw the yellow school buses pick up the neighborhood kids with brand new backpacks and clean sneakers. I can remember being anxious about heading back to school. What class would I be in, what was my teacher like, ……

It’s the most wonderful time of the year!

No, I don’t mean the winter holidays – I’m talking about the start of football season, which has finally arrived! We have patiently waited over six months for tomorrow to mercifully bring the first game of the NFL season. The game that gathers families together (with beer and wings, or another favorite gameday food) in…

Who Left The Lights On? Handling Shared Vacation Homes

We’re reaching the end of summer, and we’ve heard quite a few stories about family vacation properties. There’s a lot of emotion tied up in the topic. Families go for a good time. They go for gathering. And as this world has gotten so global, this may be the one or two times a year…

What We Really Mean When We Ask, “How Am I Doing?”

By: Alex Weiss CFP® | President & Wealth Manager When someone asks their financial advisor, “How am I doing?” They usually mean, “How’s my portfolio doing?” I understand why that’s the case. Financial advisors have put much effort into being known as the investment people. Unfortunately, it also means a disproportionate amount of their conversations…

Enjoying The Slow Moments

From Jenn Kovalski Hello All! It has been a while since I have connected with some of you. I am back from my second maternity leave and working with my favorite team on a part-time basis planning our 9th Annual Jimmy Fund Golf Tournament. My second daughter, Brooke Evelyn Elstermeyer, was born on 11/7/2023. Brooke…

Westside Pickler

A few weeks ago, at the family dinner table, my father-in-law dubbed me ‘Ilocano,’ which is the Tagalog (language spoken in the Philippines) word for ‘frugal’. He claims it’s a term of endearment, though Google searches beg to differ. This stemmed from a conversation about my love and constant search for great deals of any…

How to Prepare Successful Inheritors

By: Thomas Schulte | Director of Financial Planning One of the most common concerns we hear affluent clients express: “I’m fearful that passing too much wealth to my inheritors will do more harm than good.” It’s a well-founded concern. Far too many examples of wealth are those passed carelessly between generations, bringing out the worst…

Every Day Is Saturday

By: John Napolitano | Founder and Chairman We have many clients who are starting to sell their businesses or retiring from companies and corporations. Many large changes occur, but the biggest are often in their routines. If you own a business or have a particularly high-performance job, you work your butt off Monday through Friday….

Making Cents: Joint Ownership Can Create Problems

Let’s start by defining to two most common forms of joint ownership. First is the joint tenants in common form of ownership. Joint tenants in common mean that each individual owner has an undivided ownership interest in the property, be it a coin collection, bank account or real estate. So if you’re a joint tenant…

Summer Hike

I’ve never been an avid hiker, but I am a fan of doing outdoor activities in the summer. We only get about 3 months of nice weather here in New England, and that pushes it, so we must take advantage of it when it’s here. Last weekend my friends and I went down to just…

If a picture is worth 1,000 words…

…what is a video worth? Being a part of a fully integrated wealth management team is an honor few can claim. We have built this firm one person at a time, one client at a time. Clients have been carefully selected because they are fun to be with and appreciate our integrating everything that involves…

Market Update: July 2024

As we continue to provide on an occasional basis for our Napier Financial newsletter readers, we’re sharing some brief perspectives from our investment team’s vantage point on what’s recently taken place in markets and the economy, and also convey some thoughts about our investment outlook going forward. Since our last update, the stock market pulled…

Making Cents: What If You Can’t Work?

Many people spend a lot of time planning and worrying about what may happen to their stakeholders if they pass away pre-maturely. Stakeholders for purposes of this discussion are considered loved ones such as a spouse, partner, children and family, your fellow shareholders of the business or the clients of your business for whom you’ve…

Fun Day at the Carnival

Summer is in full swing, which means the local town carnivals are starting to pop up and my inner childhood rollercoaster-junkie is filling with nostalgic excitement. I remember growing up in the 90’s when my dad worked for Stop & Shop Technology, and much to my delight they had a summer Employee Appreciation Day at…

Making Cents: The Ups and Downs of Family Owned Real Estate

Some families intentionally pool their resources to make investments in real estate. Others inherit properties and become partners, whether that was their plan or not. Either way, owning real estate with family members can be a great way to benefit from family resources or be the straw that breaks the camel’s back with respect to…

Home Sweet Home

At the beginning of June, my wife Deidre and I finally moved into our first home in Franklin! Our entire home buying process lasted approximately six months. This included hours searching through Zillow and MLS listings, spending every weekend at open houses, making offers on the homes we deemed worthy, and having quite a few…

A Sea Shanty

Growing up on the south shore means I have some hardy seafaring friends who take the annual fishing tournament seriously (including our resident chef who comes equipped with enough homemade breakfast sandwiches to fuel 12 hours on the water.) They arrive willingly to the docks at 4am ready to push off. Our efforts have paid…

Making Cents: Your Own Team Assessment

Just like a professional sports team, it would be a wise idea for you to review your entire team of service providers. There is no time like the present to evaluate that you have assembled the right professionals to help you keep your financial house in order. The hardest part about this evaluation is judging…

Fourth of July Favorites

We hope everyone has a safe and enjoyable Independence Day ahead. In lieu of an individual person article, we wanted to share team favorites from a 4th of July celebration. Alex: While I love a great cheeseburger, I still have a love for watermelon. I can remember as a kid we used to eat watermelon by…

Making Cents: Making the Most Out of Your Financial Review

Your review meetings with your financial advisor should be about a lot more than your portfolio. Anyone can review investments and tell you why they went up or down. That service alone is not often worth the price of admission. A productive review meeting will have a detailed agenda to ensure that your whole financial…

Making Cents: Stress Test Your Forecast

With an eye toward the dog days of summer vacation, this is a good time of year to think about how you would spend your time if every day was vacation. For many, the goal of not working some day is still alive. Retiring isn’t what it used to be, however. Today, retirees want a…

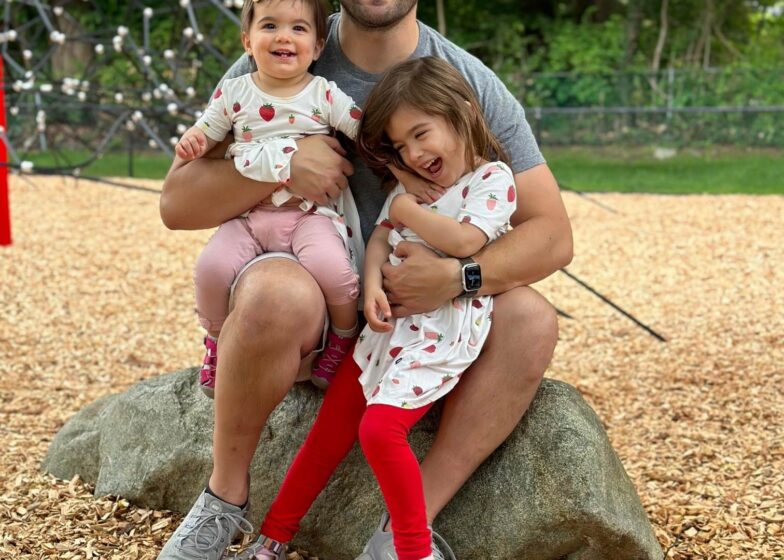

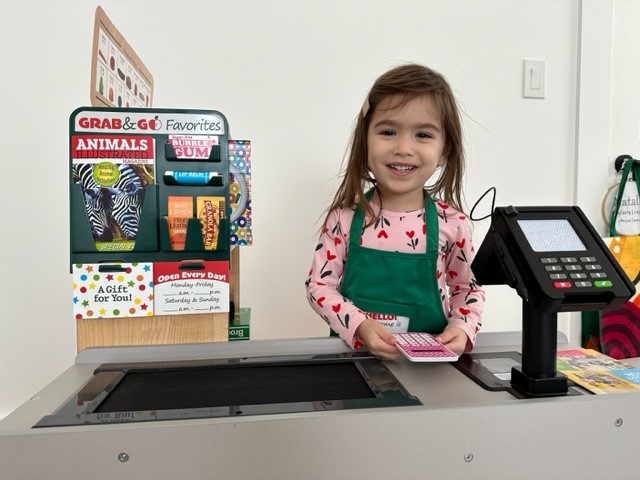

Munchkin Friday

Fridays at the Weiss household are always a little crazy. It usually starts before the sun even rises as we approach the end of the week. Everyone is excited for the weekend, but it is time for our oldest (Natalie) to go to school or now summer camp. I need to speak with my wife…

Making Cents: Dollar Cost Averaging

Dollar cost averaging is a term that has been around for many years, but always seems to get a lot more usage during turbulent markets. Whether it’s justification for continuing to invest in your 401K or simply systematically contributing new investable money into your accounts over a specified time period, dollar cost averaging is here…

‘Tis the Season

The warm weather seems to be here to stay in Massachusetts, finally. And with that comes what all people my age (26) has this time of year, weddings. My girlfriend, Liz, and I went to our first wedding of the year this past week. Her best friend was getting married at The Grandview in Milford….

Welcome back, Jenn!

After a 7-month hiatus to care for her newborn baby girl (Brooke), Jenn is coming back to the office part time. She will be working a handful of hours each week and focusing her time on our Jimmy Fund Golf tournament (Monday, September 23rd) and helping to improve our systems for a better overall client…

Making Cents: The Wisdom of Rebalancing Portfolios

For most investors, their portfolio starts out with an allocation amongst a few different asset classes. There may be large and small U. S. Equity, U. S. and foreign debt, large and small foreign equities, real estate and so on. The goal for most investors is to start with a portfolio that is broadly diversified…

Making Cents: Beneficiary Planning for Senior Citizens

It is second nature for many senior citizens to save as much as possible. These same seniors are such savers, that they are equally reluctant to spend any of their savings. This natural aversion to spending also applies to their retirement accounts. Whether the retirement account is a pension, 401K or an IRA, holding on…

West Coast Eats

Most Monday mornings when catching up with my fellow Napier team members, I find myself stealing the phrase ‘I spent the weekend eating as if I were going to the electric chair.’ It’s shameful, since I value healthy practices of all kinds, but I also give myself some slack since visiting different areas and their…

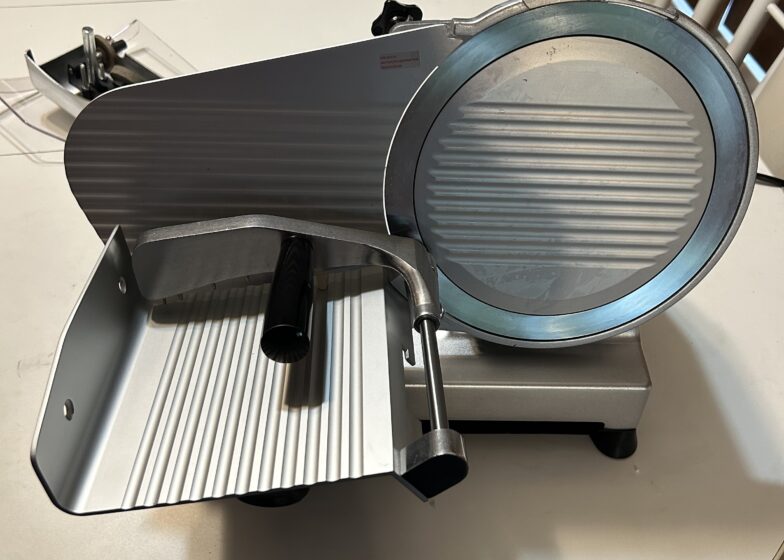

Special Delivery

About a month ago while at my Nonna and Nonno’s house for Sunday dinner, Nonno approached me with a very specific request; to order him an electronic meat slicer. For a normal grandfather request this may seem odd, however, nothing surprises me when it comes to my family and food. I’m sure my Nonno was…

May 2024 Investment Update

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Legal counsel should be consulted for specific advice or recommendations about any individual’s personal legal circumstances. Investment and financial planning advice offered through US Financial Advisors, a Registered Investment Advisor.

Memorable Memorial Day

The days are getting long, and summer is inching closer. Memorial Day weekend is only days away, serving to many as the annual kick-off to summer. By now everyone has a handful of their summer weekends spoken for, and it always feels like time is on our side. We have time for barbeques with family…

Making Cents: When Your Own Success Is an Impediment

The day the Queen of Soul died, I jokingly asked “I wonder what type of mess she left for her heirs”. At the time, the comment was truly in jest, but sure enough, just like many before her, it appears that Aretha Franklin died without a will. Why would someone do that is the big…

Making Cents: Newlyweds Need to be on Same Page Financially

We are currently in peak season for weddings. If one were allowed to give a financial toast to the newlyweds, here’s what I’d say. Money is the root of all evil, but like any tree, a good root system is necessary for anything constructive to happen. Have a conversation about money to begin to understand…

A Mother’s Day Retrospective

For many people, Mother’s Day is one of the best days of the year. We all have a reason to celebrate, if it weren’t for your mother, you wouldn’t be here! Mother’s Day is often the first type of outdoor family activity of the season for those stuck in the great white north. The flowers…

Making Cents: Estate Planning for Digital Assets

I refer to estate planning as the process of organizing one’s personal and financial affairs in such a way as to minimize disruption, cost and taxes upon the death or disability of a person. You don’t need a lot of money to have an estate plan. All that’s needed are people you care about and…

Welcome Yoyo Chen!

A few weeks back, we welcomed Yoyo Chen to the Napier Financial team. She joined our operations team, and most people on this weekly newsletter will connect with Yoyo (if they haven’t already) in the next few weeks or months. Not only is Yoyo smart and has a wonderfully warm personality, she has a bunch…

Making Cents: Divorce and Money

It’s no secret that many couples end up airing their grievances in court. About 50% of our married population ends up in divorce, with second marriages showing a higher rate of divorce at around 65%. Rarely looked back upon with fond memories, the battling and legal costs associated with divorce brings anguish. Almost as rare…

Fridays on the 405

At the end of a trying week of elementary school, us kids deserved a release, an exclamation point crossing the threshold from learning minds to wacky-weekend-warriors. After years of observation and experimentation, our beautiful brains learned that we could clip in seatbelts from across the aisle to create a makeshift swing. Parlay that with ‘the…

My Kind of Golf

Golf has always been an interesting sport to me. I try my hand a few times every year, enjoy more than a few beers with my friends, and judge how well I do by if I finish with any of the balls that I brought. So far…….no luck. That’s why TopGolf has always sounded like…

Making Cents: Does Using an Entity To Own Property Provide Protection?

As with many things financial, the answer is maybe. The type of protection and the type of entity you are using will determine just how protected your assets are from potential problems. A very common example is the ownership of rental real estate. If you own rental real estate in your own name, and someone…

Disney For The Win!

Last week, Ashley and I took our two girls down to Disney for a week to spend some much-needed family time together. The trip was a blast and we had near perfect weather to accompany us, which helps. It started with our girls’ first time in an airplane – which, at that moment, was the…

Making Cents: Is Retirement All It Is Cracked Up To Be?

According to a business owner who recently failed at retirement, ‘retirement isn’t all it’s cracked up to be’. For this individual, it wasn’t about the money, it was about the feeling of loss once he wasn’t the boss and in control. He felt as if his purpose in life had simply disappeared. This is more…

Making Cents: Real World Finance for your College Graduate

As another college graduating class enters the real world, please use this opportunity to give them the only formal lesson they likely didn’t get in college. That lesson is real world finance 101 and how to live fiscally responsibly and within your means. There are many new grads looking for work related to their newly…

California Dreaming

What a week my wife Deidre and I had visiting beautiful southern California. We were in town for one of my cousin’s weddings and decided to go the week leading up to the wedding as a small vacation. Staying at my grandparent’s house in Vista, we certainly made the most of our time. Here is…

Making Cents: Sometimes Irrevocable Is Good

When it comes to implementing an estate plan, the word irrevocable is a common part of the discussion. While it may sound scary to do anything irrevocable, in estate planning there are several instances where it may make sense. The first of these may be for asset protection purposes. When assets are left outright to…

Market Update April 3, 2024

As we continue to do on an occasional basis for our Napier Financial newsletter readers, we’re sharing some brief high-level perspectives from our investment team’s vantage point on what’s recently taken place in markets and our investment outlook ahead. Since last January’s investment update, stock markets have pretty much gone nowhere but north. The reasons…

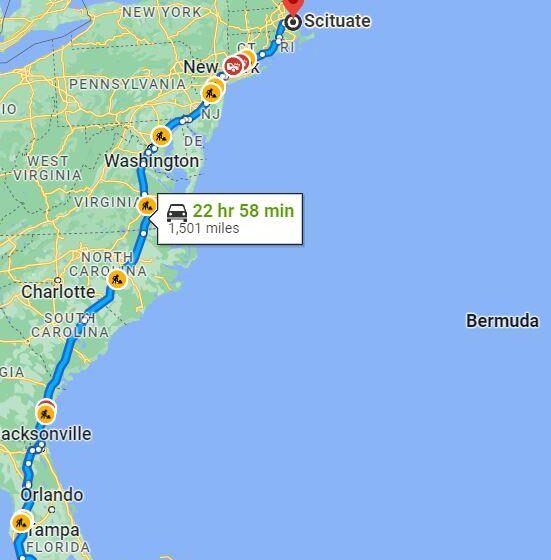

Southbound and Down

We head out tomorrow – another beautiful week in sunny south Florida to visit our families. Jennas mom, who the kids call Nana Lise, lives in southeast Florida, while my parents, John, and Joan (Nana Joanie and Papa) live in southwest Florida. The kids have a blast every year and look forward to it with…

Making Cents: Preparing to Sell Your Home

With the arrival of spring, now’s the time when many who have thought about selling a house get a little more serious. If the house needs some work to get the attention of today’s buyers, speak to a professional about which repairs may give you the best return on your investment. That professional could be…

Making Cents: The Rule of 168

The rule of 168 isn’t some fancy way of seeing how fast your money doubles or a code section from the IRS, it is a law of life. The law is that there are only 168 hours in a week, and you need to use them wisely if you want to live the ideal life…

Spring Has Sprung

Maybe a day earlier than many remember, but at 3/20 just after 11 PM, the Spring Equinox is upon us! All that really means is that the days are now longer than the nights, and for many of us that is a welcoming sight. This is officially my 68th spring, and I think that it…

Fishing With Dynamite

As I alluded to in a previous article, I was very much looking forward to the Genesis Invitational PGA event being held down the street from me. There are so many reasons to love PGA events, even for the non-golf nuts; beautiful landscapes, house snooping, food, drink and lounge areas to name a few, but…

Making Cents: Temporary Renting of your Personal Real Estate Has Many Possible Risks

Whether it’s called home or room sharing, short term rental arrangements (or whatever the regulators ultimately call it), millions of people have jumped on the bandwagon of either renting or advertising rooms for rent for as short as a single night. This may work wonders for your cash flow if you need extra money, but…

March 2024 Investment Update

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Legal counsel should be consulted for specific advice or recommendations about any individual’s personal legal circumstances. Investment and financial planning advice offered through US Financial Advisors, a Registered Investment Advisor.

Stop that Train

Just a few weeks back, our oldest, Natalie, asked us if she could take a train ride because she has only seen them and not been on one yet. Not like we avoided it – it just hadn’t happened yet! Then on a bright and sunny Saturday morning, we decided to check the commuter rail…

How to Avoid a Financial Family Feud

All too often families fight about money. Commonly these feuds begin over real estate, family businesses or care decisions for aging parents. No parent’s dream for the future of his or her family includes disownment or troubles among the siblings, yet parents are most often the ones to blame for the problems. Preventing future feuds can…

Making Cents: There’s More to Risk than Losing Money

When most people think about financial risk, losing money is what they think about. Memories of the real estate investment or stock investment that didn’t work out as hoped may still be stuck in your mind. But risk is much broader than just losing money, and the more money you have, the more likely it…

Need for Speed

As any car enthusiast can attest, winters are always the worst time of year in New England. Many of us put away our favorite cars for the season to avoid the buildup of rust and the mountains of salt and sand deposited on the road that tear away at the undercarriage. Being unable to drive…

Making Cents: Retirement Accounts Need Special Attention in Your Estate Plan

I frequently see people who think that their will directs who gets their retirement accounts after they pass away. This isn’t necessarily true. The only time your will matters in terms of your retirement accounts is if you haven’t selected beneficiaries or if all of your chosen beneficiaries are deceased. This last choice, however, is…

The Stupid Bowl

Is it my age or is the Super Bowl losing some of its luster? My friends who are Giants fans are thinking that I’m spoiled from all the Patriot’s Super Bowl appearances, and that I just can’t accept any other teams being in the big game. That is not true, I found that when my…

Making Cents: Planning for Children with Special Needs or Dependency Issues

Between what appears to be a larger percentage of children born with special needs and the recent epidemic of opioid addiction and dependency, many parents need specialized guidance in order to best assist these children and ultimately, protect their assets from the issues that can easily drain any estate. The core issue is the child’s…

Making Decisions About Your 401K After Switching Jobs or Retiring

For those who have changed jobs or retired, you have learned that you have options regarding your 401K plan post-employment. In short, you can; take the balance and spend it, keep it in the former employers 401K plan if permitted, roll it to an IRA and self-manage or roll it to an IRA for an…

Making Cents: Price Inflation may be Higher than you Think it is

Calculating the rate of inflation seems rather simple. If you pay $10 for something today and one year later that item costs $11, you would think that the item has inflated by $1 or 10% over the past year. But when it comes to the rate of inflation, there is yet another variable to factor…

An Update from Out West

Despite the historic flooding, run-ins with coyotes and a 4.8 magnitude earthquake I experienced while on the phone with Dante, I am settling in nicely here in Los Angeles. The well-wishes from so many of you have been deeply appreciated and I wanted to offer an update on things now that I am here: Move…

Succession Plans for Privately Held Businesses – Part III

In the last two weeks, we’ve talked about the different parts of planning for business succession. In our first article, we talked about the operational preparations that must be made (read the article here). Then last week, we started discussing the financial implications of business succession, including valuations of the business and any real estate…

Succession Planning for Privately Held Businesses Part II

Last time, we wrote about the operational side of succession planning. In case you missed it, you can read it here. Continuing with our series, we’re moving on to the financial side of succession. There are a few key ingredients: who will become the new owners of the deceased shares, and what are the financial…

Winter Peaceful-Land

Alright, I may be in the miniscule minority here, but who else does not mind shoveling snow?? Cue the cricket noises. Don’t get me wrong, I would rather not have snow to shovel at all. Especially when I do not receive any help in this department. However, it’s not that bad. What I enjoy most…

Making Cents : Game Changing Life Transitions that need Attention

Most people approach their financial planning on a piecemeal basis. They look at their portfolio every now and then. They talk to an estate planner every 10 or 20 years, even though it should be more frequent. They buy their life insurance in a vacuum and never look at it again. They buy and sell…

Avoiding Battles about Money

According to a 2012 Harris Interactive poll, about 36% of all couples aged 55 – 64 argue about money. That’s the highest percentage amongst any age group and significant because people in that age bracket are either retired early or thinking about the day that they may stop working. Most life and financial transitions are…

Legoland

For Christmas this year, our oldest ask Santa for one thing, and one thing only, a Lego Unicorn. After searching the internet far and wide, the only Lego Unicorn we could find was at Target for $9. We bought this, plus a Star Wars X-Wing that was put in my stocking, and they were both…

Baby Nap Is A…

The Rob Napolitano family is thrilled to be expecting….. A Boy!

Succession Plans for Privately Held Businesses – Part 1

The Operational Side of Succession Planning As an owner of a private business, you know that nothing lasts forever. And that includes you, your management team, and other key players in your business eco system. I’d like to start the conversation as if the majority, if not all, of this privately owned business is…

We Have An Announcement To Make…

While it’s far too late in the year to still be saying it, this is my first personal note in 2024 so, Happy New Year everyone! We hope 2024 will be filled with love, joy, and personal growth for everyone. In our home we are EXPECTING big things… You guessed it: Another baby Nap is…

Timeline of Tax Forms

It’s everyone’s favorite time of year again – tax season! There are several dates to be aware of regarding your tax forms from LPL Financial and other asset custodians. Most of the tax forms will be mailed out between January and March to meet all IRS deadlines. You may also find copies of the tax…

Myths About Financial Advice

When it comes to choosing a new financial advisor or evaluating your current advisor, there are some very basic elements that you need to consider. To get you in the right frame of mind, consider these myths and new realities. Myth number one is about competence and success. Believe it or not, the most successful advisors…

Busting Myths of Financial Service Firm Independence

Most financial services firms tout their independence and how they are always looking to do what is in the best interests of their clients. But the truth, of course, isn’t so simple. Let’s start by busting a few myths about adviser independence. First may be the myth that because someone practices as a fee-only adviser…

Making Cents: How do you know when it is Time to Sell your Business

If there’s one big mistake that business owners make, it’s failing to exit their business on their terms and within a proper time frame. Simply put, too many owners stay in the saddle too long and miss the opportunities to time their exit well. They miss it for a myriad of reasons. Some don’t make…

Westward Bound

I’m truly excited to announce that later this month, I will be carrying the Napier flag from southeastern Massachusetts to southwestern California. This move will allow me to pursue longstanding personal and professional goals, while maintaining my commitment to the team’s financial planning services. I will also be guiding a carefully vetted opportunity the firm has…

Making Cents: Family Business Succession – Enhancing the Odds of Success

The odds of successfully transitioning a business from one generation to the next are extremely low. In fact, as each generation grows to the point of needing a successor, it is even less likely that a transition to the next generation can be successfully accomplished. Succession is something that should always be on the minds…

Napier Financial Investment Update

Happy New Year everyone! As we continue to do on an occasional basis for our Napier Financial newsletter readers, we’re sharing some brief high-level perspectives from our investment team’s vantage point on what’s recently taken place in markets and our investment outlook ahead. Looking back at 2023, we think it’s fair to assume that markets…

Onward to 2024

As I dropped off our oldest, Natalie, at pre-school on Tuesday morning – after two plus weeks off – she was carrying a poster board with her. She was assigned some ‘homework’ over winter break to share with her class all the things she has done during her school vacation. Natalie got to pick out…

MAKING CENTS: Clever Terms to Investigate

Financial services marketers are quite clever at getting you to see their point of view. In their creative genius, they use words that sound quite appealing to most people and utilize those words to fit your situation making what they’ve got to sell sound like your only solution. The first such word is guaranteed. You…

Team Holiday Pictures

Enjoy holiday pictures from the Napier Team!

MAKING CENTS: Gifts that keep on Giving for those you Love Most

Many folks have begun making progress with their year-end and holiday gifting. Just in case you’re typically one of those last-minute shoppers with no idea what to get for your closest family members, consider helping them get some financial things done that are frequently unattended. For young children, consider a 529 college savings plan. Most…

How Competent Is Your Advisory Team?

Most people have a cadre of professionals that surround them. These professionals typically include an accountant, attorney, investment person, insurance person, banker and whomever else is needed to service your personal financial issues. What continues to shock me is the tolerance that people have for professionals who are either incompetent or lackadaisical about serving their…

Making Cents: Household Employees May Cause Tax and Liability Problems

A household employee is someone that you pay to perform duties in or around your home. A household employee is considered an employee for tax and liability purposes if you control when, where, how or by whom the work should be performed. This list of people commonly includes nannies, medical caregivers, housekeepers, chefs, personal assistants,…

Damn this Thoughtful Gift!

Please allow me a minute while I climb atop my soapbox…. Wasn’t it wonderful when Malcolm Butler engaged his bionic eye to calibrate exactly where the pass was being thrown to make the interception that inevitably won Super Bowl XLIX for the Patriots? Or when Brad Marchand leveraged his nifty robot wrist extenders on his…

Year End Tax Moves To Consider

In a famous tax court case from 1934, Judge Learned Hand spouted what is now a famous quote amongst us tax nerds. Justice Hand said that “anyone may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury;…

Dante Gets Married!

The day has finally come and gone, culminating with my marriage to my beautiful (now) wife, Deidre. We could not have asked for a better ceremony and reception for our wedding. It was an amazing day on which we got to express our love for one another in front of all our family and close…

Making Cents: Year End Gifting Unwrapped

We always get a lot of questions surrounding gifts. Most of the questions are about either charitable giving or family gifts. Starting with gifts to family, the tax code permits annual gifts to be excluded from gift taxes if it’s less than $17,000 per donor and donee. That means you can give up to $17K…

Making Cents: Guidance On Last-Minute Contributions

Many have spent the last month racking their brains thinking about gifts for their loved ones, friends or service providers. Yet when it comes to charitable contributions, many simply give at the end of the year without much thought about the tax consequences. Cash works great, and is most sought after by charitable organizations with…

Lions And Tigers And Bears

When we think of things that scare people, we often think of the world of Nature. Dorothy and her friends on the Wizard of Oz feared Lions and Tigers and Bears, oh my! For me, the natural things that freak me out are the things that shouldn’t be here in the first place. Also known…

Friendsgiving

This time of year, we try to remind ourselves of the things that we are thankful for: family, friends, our financial planners, and wonderful Thanksgiving food. And while I consider myself lucky to have all these important things, I felt as though I had neglected the friends’ part for a period of time. Life gets…

Slumdog Giftcard-ionaire

Surprisingly, there’s not a whole lot going on in Boston’s South End on weeknights. The evening walks are great and if you’re looking for a nice dinner out, you’re in luck. But in terms of weekday night activities, the landscape is barren, with one exception: Wednesday night trivia at Cleary’s in Back Bay. The venue…

Making Cents: Where Entrepreneurs Go Wrong

The lives of many entrepreneurs frequently get defined by their business. Business owners are typically smart, hard driving people with their eye on one thing only – SUCCESS. Entrepreneurs take on an alter ego that makes it very difficult to separate their lives from their business lives. There are six common missteps that, if avoided,…

Making Cents: What Does Your Parents’ Estate Plan Say

Speaking to your children about money is not easy, but speaking to parents can be even tougher. No parent goes through life wondering how they can ruin their finances or make their adult children miserable while settling an estate without a plan. Yet it seems that this scenario is more common than the elder parent…

Winter Is Coming

That doesn’t usually invoke people’s warm and fuzzy side ‘round these parts – and by March I know I will be singing a different tune as well. All jokes aside, my family has had a pretty great run since Labor Day, and in my opinion the best (Thanksgiving) is yet to come. This year my crew…

Trick Vs Treat

It was another eventful night in our neighborhood for a classic New England style Halloween. The leaves are turning, the cool air rolled in, and the streets are full of kids looking to fill that plastic pumpkin with as many sweet treats as possible. The adults mulled some cider and wagons were in full force…

Making Cents: What Is Volatility And Why Does It Matter

Unless all of your savings are stored in guaranteed rate instruments like bank accounts, you have probably felt the consequences of volatility somewhere. Volatility in the investment world attempts to measure the stability or susceptibility of your investment to sudden changes in value. These sudden changes cut both ways. Volatility can cause the value of…

Making Cents: Money Is The Root Of Many Family Problems

A common goal for most parents and grandparents is family harmony. They hope that the family will stay close and love each other beyond their lifetimes and for generations to come. Unfortunately, these dreams often fail to come true through a combination of their naivety, poor planning and weak communication. The reality is that you don’t…

The Four Corners Of The USA

While I enjoy travelling abroad, I am recently reminded of the beauty and grace of the many places to visit in the USA. A business trip combined with a little pleasure, I have had the opportunity to touch all four corners of the USA. The itinerary over a 4-week+ period went like this. Boston –…

TS Tied the Knot

The deed is done! After a roughly twenty-four-month long engagement, Khrista and I were married on October 6th in Santa Monica, California. Apart from just one cancelled flight from the east coast, all the events went better and more smoothly than we could have ever imagined. Allow me to share a few photos from the…

Making Cents: Protecting Your Assets For The Next Generation

Many people are more concerned about preserving their wealth for the next generation than they are about their own well-being or bucket list. Hat’s off to you paternalistic savers – your next generation would thank you if they only knew how you really feel. Many make gifts that they can’t afford and avoid spending on…

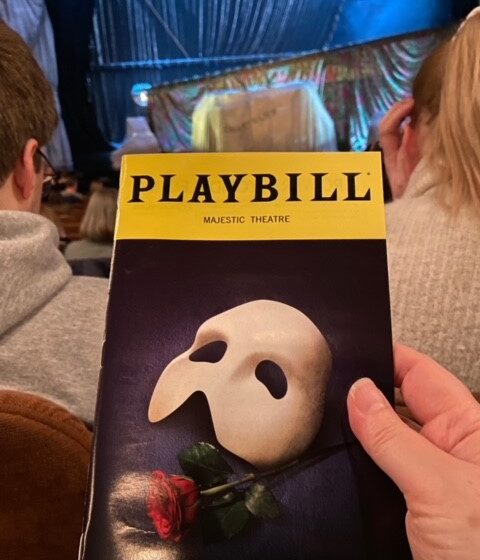

Back and Forth to NYC

Last March I had written for the readers of this column that it had been years since I had last visited New York City, while extolling its cultural virtues. My enthusiasm must have rubbed off on my son, for lo and behold he announced to us about a month after the article was written that…

Making Cents: Is It Best To Make Gifts Now Or Transfer Property At Death

Naturally, this answer is going to be different for everyone, so let me talk about the common mistakes and pitfalls of either bequeathing property at death or gifting while you are alive. Starting with transfers during your lifetime, one of the biggest issues that we see often surrounds the ultimate income tax consequences with lifetime…

Market Update

Given all the events in motion with the economy and markets these days, on an occasional basis we will continue to provide some brief perspectives from our investment team’s vantage point on market trends for our Napier newsletter readers. Here’s some responses to questions we’ve been fielding recently: What’s changed from your last piece in…

Travel Is Back

It feels to me that everything travel related is back in full swing. It really started earlier this year and ramped up in the summer. Airports are full, highways are busy, and hotel prices are up (if available at all!). I have had a little travel myself over the past few weeks, with my first…

Making Cents: How to talk to Elderly Loved Ones about their Estate Planning

In many ways, this is one of the most important issues that I see, and one of the least frequently discussed within the family ranks. The topic is family awareness of the aging parents’ financial situation and estate plan. All too often adult children are surprised at the poor planning that their parents did to…

A Record-breaking Jimmy Fund Tournament!

A record-breaking year in the books! This past Friday we held our 8th Annual Napier Financial Jimmy Fund Golf Tournament in honor of Mike Aizenstadt to benefit research, treatment, and the eventual cure of Acute Myeloid Leukemia (AML). Due to the unbelievable generosity of individuals, families, and local businesses, we achieved our goal of raising…

Jenn Incoming and Outgoing!

As you may already know, our beloved Jenn Kovalski is having her second child in November. She, John and her almost 2-year-old daughter Tessa eagerly await the arrival of #2. There is a possibility that this new child will be born on the birthday of her older sister, Tessa. Only time will tell. Effective the…

Making Cents: How Close Should You Watch Your Plans?

A financial plan is just that, a plan to help attain the financial freedoms you want while taking precautions so that the unthinkable doesn’t sink your ship. This requires diligent coordination of many moving parts. Those parts are, but not limited to, cash flow, inflation, earnings, investment performance, tax laws, estate plans, insurance plans, family…

Dante Coppola, CFP®!!

I did it! I have climbed the mountain and achieved the pinnacle of my profession. I’m referring to me acquiring the Certified Financial Planner™ designation, of course. My CFP® path took almost four months of intense studying, two whole years of educational courses, course exams, and a comprehensive project, but I finally passed the CFP…

Making Cents: Beneficiary Choices Need to be Reviewed

With certain assets, it doesn’t matter what your will says. Upon your passing, these assets will flow to whomever you elect as the beneficiary of each individual account. Beneficiary elections are made for retirement accounts and insurance contracts. Typically, these beneficiary elections are made when you establish the account. For certain retirement accounts, these elections may be…

And Then There Were 7

A little over 5 years ago, I wrote to you with excitement about expecting our first grandchild. Everything about that has been exciting including today’s first day of kindergarten. And while she was growing, she had the pleasure of witnessing the birth of two brothers and four cousins. For those good at math, yes, that…

Making Cents: Downsizing Doesn’t Always Mean Down Costing

If you are amongst the millions who have an extra bedroom or two, the thought of downsizing the home seems to be “the” topic at backyard barbeques. Now that the kids are grown and gone, or almost gone, you may be asking why you should continue to pay the property taxes, heat and other costs…

Making Cents: Do Your Homeworking When Picking A Financial Advisor

If part of your plan for the New Year is to hire or change financial advisors, it is never too early to start that process. Many people do not ask enough questions when vetting out a new advisor, and simply hope for the best. Ask is what the prospective planner feels is his or her…

Welcome Michele!

Welcome Michele! Without further ado … drum roll please … Say hello to the newest member of the team, Michele Schulz! Most of you know by now that Jenn is expecting her second child soon and her plan is to take maternity leave until Spring 2024. In order to continue our high level of service…

Making Cents: Price Inflation May Be Higher Than You Think It Is

Calculating the rate of inflation seems rather simple. If you pay $10 for something today and one year later that item costs $11, you would think that the item has inflated by $1 or 10% over the past year. But when it comes to the rate of inflation, there is yet another variable to factor…

Best Meal Out

Ashley and I had the joy of being able to go on a date without our two kids this past Wednesday. We have been trying to get to a specific restaurant for over two years, but reservations were hard to come by and our time was limited to be able to sneak out. Alas –…

Middle School Sports Hero

Rudy! Rudy! Rudy! A common daydream of the not-so developed mind of a teenage boy is that of being the hero of a game. Walk-off home run, buzzer-beating 3-pointer, overtime goal – the list goes on and on. The play is made, the referee confirms the glorious moment, and you are hoisted on the backs…

Making Cents: How To Pick A Trustee

A trustee is generally a person or a company who oversees the governance and maintenance of a trust. For some trusts, you may be your own trustee while for others, you may need or want an independent trustee. For simplicity sake, realize that if you are your own trustee and have the power to reach…

Making Cents: One Thing About The Internet, You Can’t Take It With You

Sometimes things that are designed to make life simpler seem to complicate matters further. Take the ever growing presence of the internet. How many websites, user IDs, and passwords can any one person endure? Especially in this world of changing passwords and identity protection. Mainly due to security reasons, the internet, which was supposed to…

The Birthday Dash

It feels like most families have this – you have a stretch of birthdays/celebrations within a few weeks time that feels like a marathon of food, cake, and gatherings. On my side of the family, that is the month of October. But on my wife’s side, that is the end of July into early August,…

Making Cents: Expanding Your Annual Financial Check Up

As the calendar marches toward the final quarter of the year, there are certain financial rituals that many astute investors embrace. They routinely scour their portfolios for gains or losses to harvest, see that their allocations align with their expectations and they plan for ways to reduce the income taxes that they’ll pay for the…

The Dog Days Of Summer

We’re halfway there… it surprises me every time, but August 1st has come and gone. My family has managed to pack a lot of fun in thus far – and there’s no slowdown in sight! I will admit, the weather has been a bit odd. Rain, or at least its forecast, has been a damper;…

Making Cents: Managing Risk

Many say that an analysis of risk should be the first step of the financial planning process after you’ve compiled your financial statements and enumerated your dreams, goals and objectives. The reason for starting with risk is because the occurrence of an unplanned risk may prevent your best laid plans from ever having a chance…

Quiet Summer

Where does the summer go!? This month of July seemingly has flown by, and get this folks, I have not been to the beach yet once! Sadly, my beloved days at the beach have been dictated by the constant (incorrectly predicted) rain in New England and Tessa’s stringent nap schedule. Beach days have been replaced…

Making Cents: Why Get Your Financial House In Order?

Perhaps the most common reason for the gaping holes in one’s financial plan is the lack of focus on what you are trying to accomplish. Why get your financial house in order? During the course of my week as a financial professional, we frequently see people with gaping holes in the financial plans. Some have no…

A Great Day For Sportsmanship

Last Sunday here on the Irish Riviera (one nickname for Scituate, MA) was not a great day for outdoor activities. The day was a complete washout reminiscent of South Florida style storms complete with thunder and lightning. Frequently on days like this, I have a saying that it is “a great day for indoor sports”….

Making Cents: When It Comes To Money, Treat Family Like Anyone Else

Most people seek out financial guidance to help protect wealth for their lifetime and to preserve it to the extent possible for future generations. But it seems that the more financial independence that you have, the more you begin to feel and look like a target by your friends and family to help them with…

Thirty, Flirty, and Thriving?

Taken from one of my favorite rom-coms, Jennifer Garner’s 13 Going on 30 – this title/mantra from a 13-year-old teenage girl has taken up far too much real estate in my head recently. Though I am not flirty nor unquestionably thriving, I am in fact thirty as of mid-June. And though my mom loves to…

Happy 4th 2023 From the Napier Team

We hope you had a great 4th of July, and enjoyed celebrating with family and friends! Here are a few photos from the day…

Making Cents: College Grads Face More Challenges Than Ever

This time of year, I always like to say something positive to the new entries into “the real world”. New college grads have always had challenges transitioning from the college world into a world of work, bills and responsibilities. In today’s economy these grads face as many challenges as ever. Many have large amounts of…

Making Cents: Precautions Can Mitigate Losses In The Next Storm

Stuff happens, and there are obvious natural disasters that no one can prevent. But getting your house in order to protect what is important to you is something that you can start to fix today. What would bother me, for example, are the drawers of old photos from my childhood and then of raising a…

From Financial Planning To Wedding Planning

I’m sure all of you are getting tired and bored of us constantly talking about our weddings by now. However, it is one of my biggest life events (so far) and has taken up a lot of my time and planning in the last nine months. So, here’s another, slightly different, article about planning for…

Making Cents: Myths About Financial Advice

When it comes to choosing a new financial advisor or evaluating your current advisor, there are some very basic elements that you need to consider. To get you in the right frame of mind, consider these myths and new realities. Myth number one is about competence and success. Believe it or not, the most successful…

A Busy Summer Ahead

This seems to be the year a lot of people are getting married! Just in our office alone, Mr. Tom Schulte is getting hitched in October and Mr. Dante Coppola ties the knot in December. Ashley and I seem to get invited to at least one wedding every other year given how large our families…

Father’s Day

Despite what I told my husband yesterday, Father’s Day is this weekend, not in two weeks. I am as unprepared for this holiday as I am for this article. I do feel kind of bad about my lack of preparation because I am surrounded by some seriously awesome super dads and father-like figures who deserve…

Making Cents: Planning Your Rewarding Retirement

Perhaps this is your year – the year you finally get to spend your time exactly how you want, and maybe slow down or call it quits from work. Whether now or later, these are some of the matters that you may want consider now. Not working will free up a lot of time, and you…

Market Trends June 2023

Given all the events in motion with the economy and markets these days, on an occasional basis we will begin providing some brief perspectives from our investment team’s vantage point on market trends for our Napier newsletter readers. Looking back over the past several months, equity markets have had a lot of serious issues thrown…

The Heat Is On

No Celtics fans, I’m not talking about the domination that the 8th seed Miami Heat brought onto the Celtics, I’m talking Hot Peppers. When I arrived back to Scituate from FL, I realized that I only had 3 ball jars of the Famous J Nap Hot Pepper Relish remaining. As a result, I spent Memorial…

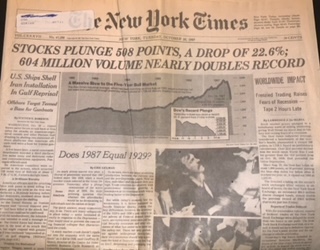

Making Cents: Take the Noise in Stride When Considering Investment Approach

Looking back over history there are many times when policy, politics and fear overcame markets. It happens in just about every market; real estate, Wall Street, Currencies and Commodities both domestically and abroad. Sometimes these markets react favorably and other times, unfavorably. What is exceptionally tough to do is to use policy, politics and fear to…

Office Reopening

We are finally opening our office after about 7 weeks of construction and many months of planning. Overall, everything went according to plan with only a few minor items still on the punch list. What we confirmed in the process is that as long as we have power and Wi-Fi, we can function – but…

Market Update – Debt Ceiling Observations

Undoubtedly you’ve seen numerous stories in the media recently about the national debt and the debt ceiling. The short story is the US debt limit will need to be raised by Congress to fund the federal government’s spending obligations. If an agreement is not reached in a timely manner, perhaps by early June, it’s unlikely,…

My Wedding Draws Near: The Good, The Bad & The Ugly

The Good She still loves me: Despite a slow start out of the gate in regard to my (limited) wedding planning responsibilities, we are still on track to tie the knot over Columbus Day weekend in Santa Monica, California. As cheesy and cliché as it sounds, we are ready to drop everything, skip hand-in-hand to…

Making Cents: Real Estate As An Investment

Many people own some real estate, and for the most part, those who don’t own property still have the desire to own as a part of their financial forecast. Whether it’s your primary residence, a second home or an investment property, there are several ways to look at real estate from an investment point of…

Making Cents: When You’re In Charge Of An Estate

There is a saying about the only two things that are certain in life are death and taxes. That may be true, but for people with any assets, there is a third to be concerned about. That third issue is the resolution of the estate of the decedent. The loss of a loved one is…

Introduction to Nick Berlen

It’s finally my time. The final step in becoming a member of the Napier Team – joining the personal article loop. Here’s to hoping I have enough to say each and every time going forward. I grew up on the South Shore of Massachusetts, in Hull. My family has lived here my whole life and…

Making Cents: Knowing Your Level of Financial Independence

Many trod through life because that is what they do. They go to work, they save and spend, and they keep in that motion until they either must stop working or decide that doing something else would be nice. Some are so good at what they do, that they couldn’t fathom how they would spend…

Preparedness Paradox

It is springtime, well, at least this week in the Metro-Boston area and a lot of learning continues to happen in the Weiss household. It starts with Holly, our youngest, learning to take a few steps and now walking within a few short weeks. Then Natalie, our oldest, who figured out how to hug her…

Making Cents: Where Entrepreneurs Go Wrong In Their Own Wealth Planning

Entrepreneur’s lives are frequently defined by their business. Business owners are typically smart, hard driven people with their eye on one thing only-SUCCESS. This can make it tough to separate their personal lives from their business lives. There are six common missteps, which if avoided, can make wealth planning more effective. It can take 24/7…

A Day Full of Pastabilities

Unless you’ve lived in the immediate area, most people haven’t heard of Dave’s Fresh Pasta near Davis Square in Somerville. Somerville, you may ask? Where’s Somerville? My bad. I meant to say Sumahhville. The store’s been around for more than 25 years and sells all kinds of Italian specialties such as homemade pastas, sauces, meats,…

Making Cents: Planning for Succession of the Business

Small businesses are often credited as being a strong driver of our economy, and many are owned by one person. You may own one yourself, or have at least one solely owned business as a supplier of products or services for your home or business. In my experience, very few of these have a plan…

Spring Things

Spring is here, it can be a fleeting sensation given the still hovering above raw temperatures. But when you feel the warmth of the sun and see the daffodils, tulips and hyacinth popping up, it sure is a reassuring and optimistic feeling. Personally, I think spring has a stronger ‘fresh start’ feel than New Years….

The Lifelong Learner In All Of Us

A recent social media post by one of our great clients talking about an advanced training she received regarding building a better business reminded me just how important lifelong learning is to all of us. In our profession, you are nobody if you are not committed to lifelong learning. In fact, I write this…

Making Cents: Make Risk Assessment Your First Step

Many say that an analysis of risk should be the first step of the financial planning process after you’ve compiled your financial statements and enumerated your dreams, goals and objectives. The reason for starting with risk is because the occurrence of an unplanned risk may prevent your best laid plans from ever having a chance to…

Making Cents: Why Financial Education is Important

We live in the age of information and big data. As a result, there is no shortage of ways to obtain information about any matter of personal finance. Sometimes the information that you find is relevant and useful, and other times it is outdated and not germane to your topic or need. The problem is…

Sand Everywhere, Tan Nowhere

Years ago, I wrote a piece titled something along the lines of “The Golden Age of Entertainment.” The point to my long-winded story was that the members of my family were all in the perfect age range to enjoy the same shows, movies, humor, activities, etc. and that it was such a nice change. I’m…

Making Cents: Decoding Alphabet Soup When It Comes To Financial Advisors

Recently, a friend poked fun of my email signature because of all the initials after my name. Lots of professionals use designations in their signature; some recognizable and some not. The question you need to ask is whether the initials, (AKA credentials or designations) are necessary and would a credentialed professional deliver better service and…

Budgets Be Damned!

Sometimes you must throw caution to the wind, release your inhibitions, and let the devil on your shoulder grab the reins for a moment. We have all been there, and most of us have great stories to share because of it. As young parents that tends to take on a more docile meaning than it…

Napier Financial Office Construction Progress

Check back with us regularly to see progress on the construction of the Napier Financial Office Space! May 1st – more progress with the floor, paint on walls – almost ready! April 27th – the floor is going in! April 19th – Looking good! April 5th – Progress!! April 2nd – after a few days…

Making Cents: Are you Suffering from Familiarity Risk?

Unless you are a CPA who audits public companies, you’ve probably never heard of familiarity risk. Familiarity risk are risks that you may be incurring that are easily masked by something or someone that you simply become used to. Being too familiar with any situation may cause your guard to become lower than it should…

Office Construction Begins!

We have been planning for the last few months to update our office space, and the day is finally here. Our office has not been updated in a decade, so we are very excited to give it a fresh look. On Saturday, the demolition crew will begin taking down a few walls, ripping up the…

Making Cents: Starting A Small Business In Retirement

Everyone’s vision of retirement is different. Certainly the idea of retirement in 2023 is different than it was in 1950. Today’s retiree is more active, with many to-dos on the bucket list and the time and resources to pursue their vision. To some that means starting a small business. Maybe it’s your hobby that you’ve…

Taking a Bite Out of the Apple

It had been years since we last visited, so a couple of weeks ago when my son was home on his school break, my family decided to take the Acela down to the Big Apple with the goal of being nothing other than tourists for a few days. It can be daunting trying to figure…

Making Cents: How Can The FDIC Help?

The banking industry has seen a bit of upheaval over the past week, and we’ve seen some market volatility as a result. I’m sure you’ve seen the images of the people lining up in front of their SVB-owned local bank, hoping to get their savings back. There’s been a lot of talk about the government’s…

The Picture

I was reminded just the other day to make sure I took my phone out to capture a moment in time. Then I was quickly reminded how I could not, for whatever reason, capture a great picture of my lovely wife but I could capture a perfect picture of just about anyone else. Is this…

Making Cents: Why Many Won’t Discuss Their Finances

Many people would rather talk about their love lives than their finances. This is a conundrum to me, but I have a few theories on what may be holding you back. The fear of confirming ignorance appears to be a riskier place for many than the complacency of innocence. For many, it is as simple as…

Introduction to Dante Coppola

The day has finally come. It is my time to adorn the mantle that my coworkers have done before me – joining the personal article write up rotation. To me, this is one of the final initiations as a member of the Napier Financial team. I am typically not one to drone on and on…

Making Cents: Suddenly Bad News

We should all have our affairs in order as if tomorrow is our last day. If all of a sudden your doctor told you that you had advancing dementia or stage 4 cancer, your thoughts would be all over the place. As you pass from anger to reality, your mind eventually wanders to financial matters and…

What’s Up With The Guys

What are “the guys” up to these days you may be wondering? Specifically, where they’re going, what they’re doing and using lately. Well, I can answer that for you very easily, nothing and everything. Some things change, and some things really stay the same, but they stay dedicated to finding joy outside of the office…

Grass Ain’t Greener

Have you ever caught yourself thinking, ‘if I just had that _______, life would be so much better/easier/enjoyable/fulfilling?’ However, no matter the magnitude of desire & hope, it seems we are quickly let down with how the ________ affects our day-to-day. 2022 was the perfect example of these thoughts; I checked off a couple boxes…

Making Cents: What Type of Advice Are You Getting?

There are so many different terms used to describe a relationship with a financial professional that what you get may frequently differ from what you expected. Terms like investment consultant, financial planner, wealth management or broker are frequently tossed around with little thought as to what each actually means. Regulation surrounding the titles and services…

A True Vacation

Over the years, I’ve had a lot of business trips. There were years in recent memory where each week included an airport, rental car and a hotel. For the more distant trips, I’d always add a day here and there for some time to take in the local sites; especially when those destinations were far…

Making Cents: 401K Trustees Need To Pay Attention

If you own a business, you may have been named as the trustee of the retirement plan when it was established. The trustee of a retirement plan is responsible, in short, for just about everything. In the 401K sense, that trustee is not responsible for selecting the investments for each and every participant. But that…

Back to Hoops

Since the start of the year, I have been trying to take a little bit of time for myself for some fun exercise. I really enjoyed participating in organized sports growing up and I wanted to get back into something like that. Since I would not be able to compete at track and football wouldn’t…

Introduction to Rob Napolitano

I would like to use my first personal note as an opportunity to formally introduce myself; Who am I? What am I doing here? And most importantly, what on earth was it like growing up with John as my Father? I’ll start with the basics. I am Rob Napolitano, the newest member of Napier Financial. …

Making Cents: Selling Your Small Business

In today’s financial markets, hardly a day passes without news of one major acquisition or another. Selling a business is easy when the economy is good, interest rates are low and companies are looking for a way to deploy capital. But what about your small business? According to the Small Business and Entrepreneurship Council, firms…

Making Cents: Five Strategies For Tax-Efficient Investing

Once upon a time, retirement was defined as sipping lemonade on the front porch waiting for the grandchildren to visit. Today, however, things are different. The grandchildren may be visiting the house to feed the cat or walk the dog because the grandparents are busy. They are traveling, going out to dinner, and working. Some…

Virtual Time Well Spent

Over the past several years a lot of terrible, terrible consequences have been the byproduct of the pandemic, but numerous positive outcomes that have arisen as well. One that many of us have benefited from is how technology has improved enough to allow us to virtually communicate with each other, without ever leaving our homes….

Proactive Procrastination

I am having vivid flashbacks to high school and college, so real, it has me sweating and glancing at the clock constantly. It’s 9pm and I am writing my personal article the day before it’s due. It’s not that I don’t have anything to say (hah!) it’s just that I don’t know what to say….

Making Cents: Spending Your Retirement Wisely

In today’s world of people living and working longer, the old vision of retiring and sitting on the front porch with a glass of lemonade just doesn’t cut it. Some people may continue to work because they have to, but for others it is often because they really don’t know what else they’d do with their…

Making Cents: Financial Guidance for Elders

One of the signs that someone is aging is that they simply can’t do some of the things that they used to do. When that comes to their financial decisions, it may manifest itself in their investment choices, bill paying or some sort of financial deal or scam that may not have been in their…

The Art of the (Electronic) Deal

As a few of you have kindly pointed out over the past week, I’ve had a greenish tint to my already pale skin. I am on Day 5 of COVID quarantine and hating every second of it. Thankfully the symptoms have been rather mild, but it’s being locked down in this godforsaken apartment that is…

The Results Are In!

The Results Are In!! We asked you to vote for your favorite holiday tune, and here are the results! We had a tie for first place: Santa Claus Is Coming To Town (Bruce Springsteen) and All I Want For Christmas Is You (Mariah Carey) were the most popular amongst our voters. There was a three-way…

Making Cents: How Are Your Buckets Filled?

One strategy utilized to allocate assets and generate retirement income is commonly called the bucket strategy. In the bucket strategy, a retiree would consider setting up different buckets of money with a different investment strategy for each bucket. The buckets are established utilizing a time horizon. The first bucket should be designed to hold money…

Hello 2023

Another January 1st has come and gone which marks a fresh start to another year. 2022 had some of the highest highs in the Weiss household, but it was unfortunately matched with some pretty harsh lows. Having such a large immediate and extended family comes with pros and cons. On the bright side, you get…

Christmas 2022!

A few Christmas photos from the Napier Team… We hope you’re enjoying the holiday season with your loved ones!

Cast your Vote! All-time Favorite Holiday Tune

By the time the end of December rolls around many people have had enough of Holiday Music. I can see why, especially if you work in retail or some other venue where the music rolls on 24/7 with playlists that repeat songs regularly. Not me, in fact, I used to get a little sad when…

Making Cents: Thinking Of Large Holiday Gifts

One of the common questions this time of year is “How much can I gift to family members without tax consequences”? It’s certainly a loaded question, and the answer is, it depends. Let me explain. The Federal annual gift limit is $16,000 per donor to anyone and is increasing to $17,000 in 2023. For a…

Making Cents: Professional Skepticism

When I was trained as a rookie CPA candidate in the late 70’s, the term professional skepticism was first introduced to me. What it means is that we should not accept all stories at face value. In the accounting world, it goes even further to mean that one should corroborate or validate through examination and…