My wife and I recently celebrated our 20th wedding anniversary. Fortunately for us, we’ve had 20+ happy years together. I’m ever grateful that I met such a wonderful person who can put up with someone like me for such a lengthy period of time.

There’s another day however, that I wanted to write about.

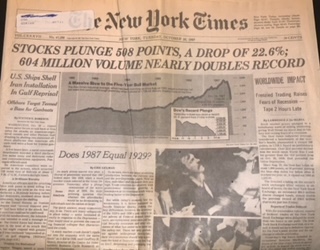

Today marks the 35th anniversary of the stock market crash of 1987, otherwise known as Black Monday.

Not only do I remember that event, but since I’m nearly 100 years old, I was also an active participant. I thought I’d pass along a few recollections from that historic day.

It’s strange considering the scope of the calamity, but really there was no clear explanation why stocks sold off that day. It took months before regulators, financial publications and participants were able to cobble together a rough thesis. As a participant, I can tell you that it was less about any fundamental economic issue, and more about investor psychology, human nature, and perhaps large pension funds and insurance companies using a no longer used controversial strategy to lock in their gains, that added to the extreme volatility that day.

Leading Up To Black Monday…

1987 started like gangbusters. By August, the Dow Jones Industrial Average was up 69% year to date. But then for various reasons, markets began to falter throughout the fall. On Wednesday October 14, Democrats on the House Ways and Means Committee agreed to make tax changes that would cause corporate takeovers to become less attractive, a major ingredient for the strength in the stock market at that time. When the news was disseminated, market weakness began to accelerate.

Fidelity, where I worked as an equity trader for the funds, was the largest money manager in the world. Money had been flowing freely into the funds for years, riding the coattails of the great bull market that began in 1982. However, for the first time that I could recollect, in conjunction with markets heading lower, investors began withdrawing money from their mutual funds. It started as a trickle, and then turned into a torrent. It became a vicious cycle: to meet investor’s cash needs, we had to sell stocks … at ultimately lower prices, and the lower prices in turn led to more withdrawals.

The Crash

By week’s end, markets were beginning to melt down and redemptions were piling up. When I left work on Friday, I could palpably feel that Monday was heading towards a disaster.

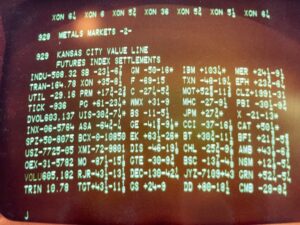

I got the call Sunday morning that all 17 traders were required to be in the office that afternoon to prepare trades for when the market opened Monday. This was pre-technology, so each trade had to be manually typed by hand. Monday morning all of us were in the trading room at some ungodly hour, locked and loaded as they say. Our instructions were not to talk to any reporters outside of our offices, use as many brokers to execute our trades as possible, don’t convey any panic on the telephone and oh, try to get great prices on your trades.

As you can imagine, it was the wildest trading day anyone could imagine. Total fog of war. Despite the furious pace, I remember feeling the day would never end, but when it had, the Dow Jones Industrial Average (DJIA) had dropped 508 points (22.6%), the largest single day drop in history. I sold, and bought as well, in record amounts. I remember leaving the trading room that night with an empty feeling in my stomach, thinking that my job, the market, and Fidelity was probably toast.

The Epilogue

The epilogue is that people who panicked got hurt, especially because markets soon picked up the pieces and resumed the great bull market again. Many investors, including me, learned a valuable lesson that market dislocations happen from time to time and the importance of focusing on long term returns, rather than near term volatility. And while it’s possible another crash of this magnitude could again happen, it’s a lot less likely due to market reforms that were enacted after the crash.