Follow Thomas Schulte on LinkedIn

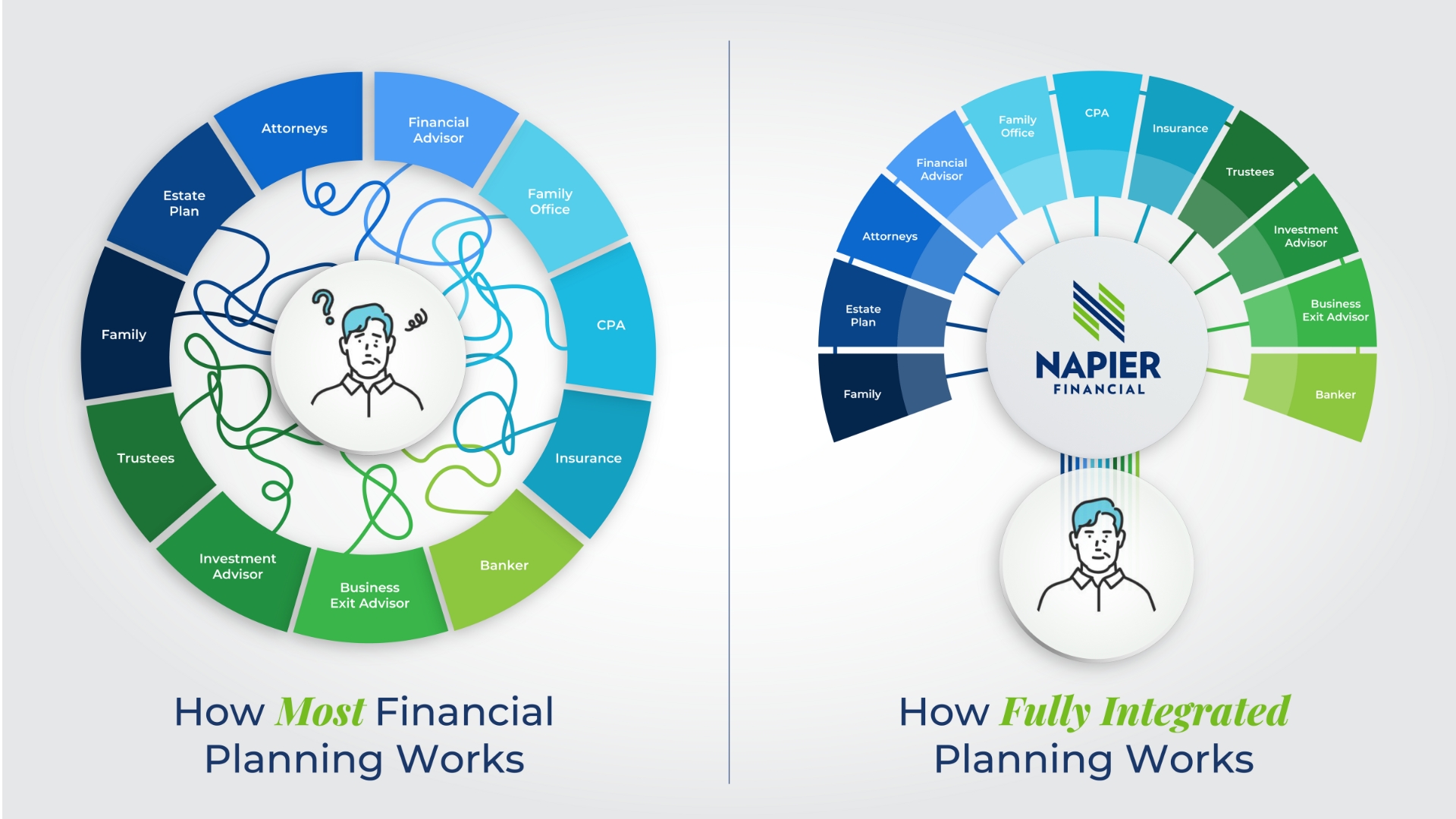

This one is prompted by something my partner, Alex Weiss, said in a recent interview. I’ll include the clip below. We meet a lot of families whose lives have changed, but their financial advice hasn’t. Usually, these families work with someone whose business card says financial advisor but primarily stays in the investment lane.

These families are usually still working with someone who talks about the portfolio every year and little else. Maybe they chat once a year with their CPA. If your net worth has grown or your life has gotten more complex, ask yourself:

When’s the last time your advisor asked you about…

- How does your estate plan actually function in practice?

- Whether your gifting strategy still fits your family dynamics?

- What would happen if you sold the business next year?

- Who would your adult kids call if something happened to you?

- How are you coordinating around state taxes, not just federal?

- Why hasn’t your buy/sell agreement been reviewed since you signed it?

- Whether your trust assets are titled properly—or still in your name?

- What’s changed in your family dynamic over the last 12 months?

If the answer is “it’s been a while” or “never”… You might not have an advisor. You might have an asset manager. Ask a few of these questions, and you’ll likely start to know which one you have.

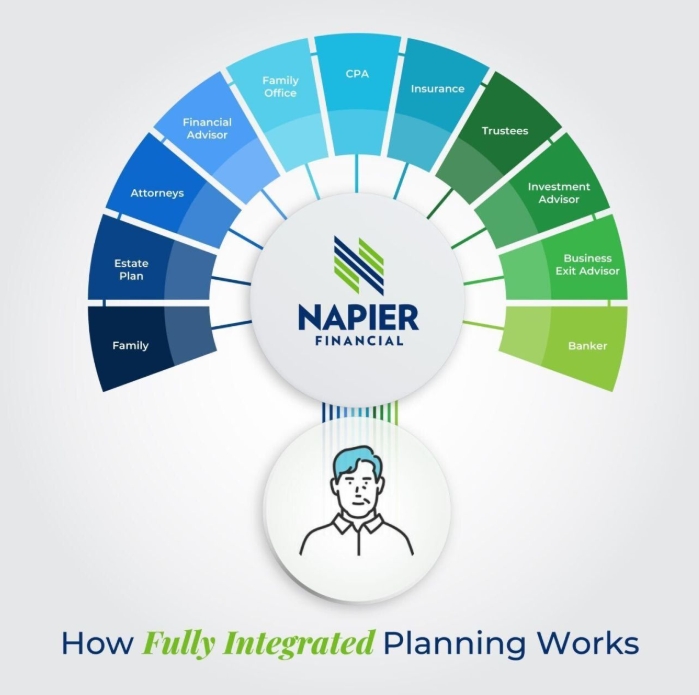

Our Fully Integrated Financial Planning approach is a direct response to the massive gaps high net worth families experience with traditional, silo-driven financial plans. The fully integrated model is well described by the visual below.

If this is something you can see greatly benefiting your family, it’s worth a conversation. We believe there’s a better integrated service available than what our industry has made common. No more siloed planning between your investments, taxes, estate planning, exit planning, real estate, and everything else that comes along. Fully integrated financial planning is categorically different and entirely realistic.