As of 12:00pm 4/9/25.

Markets continue to experience substantial volatility over Trump 2.0’s tariff policy, particularly in light of last week’s rollout of unexpectedly high tariffs on major trading partners, which triggered a steep four-day market decline. As of this writing, the Nasdaq has officially entered a bear market (down more than 20% from February 19th record closing price), and the S&P 500 is on the precipice of doing the same.

The crux of the market’s concern is that these exceptionally high levies will slow global economic growth, provoke retaliation, and upset trading relationships for years to come. This has been reflected recently in declining U.S. consumer confidence surveys and is fueling heightened concerns about the prospect of rising inflation, lower corporate earnings and the potential for a recession.

While there’s more going on these days than tariffs, there’s no doubt that’s been the key driver of market volatility. In addition to the economic ramifications, two important questions are front and center: is the Trump administration simply using this as a negotiating tool or is this something longer term in nature? If it’s the former, and agreements on trade concessions are reached in conjunction with reduced or retracted tariffs, we’d expect stocks to rally, perhaps meaningfully. On the other hand, the longer these levies remain in place, the more potential collateral damage could take place, and this might put further pressure on equities. The bottom line is the situation remains fluid, and at this point determining how the outcome will play out is impossible to say.

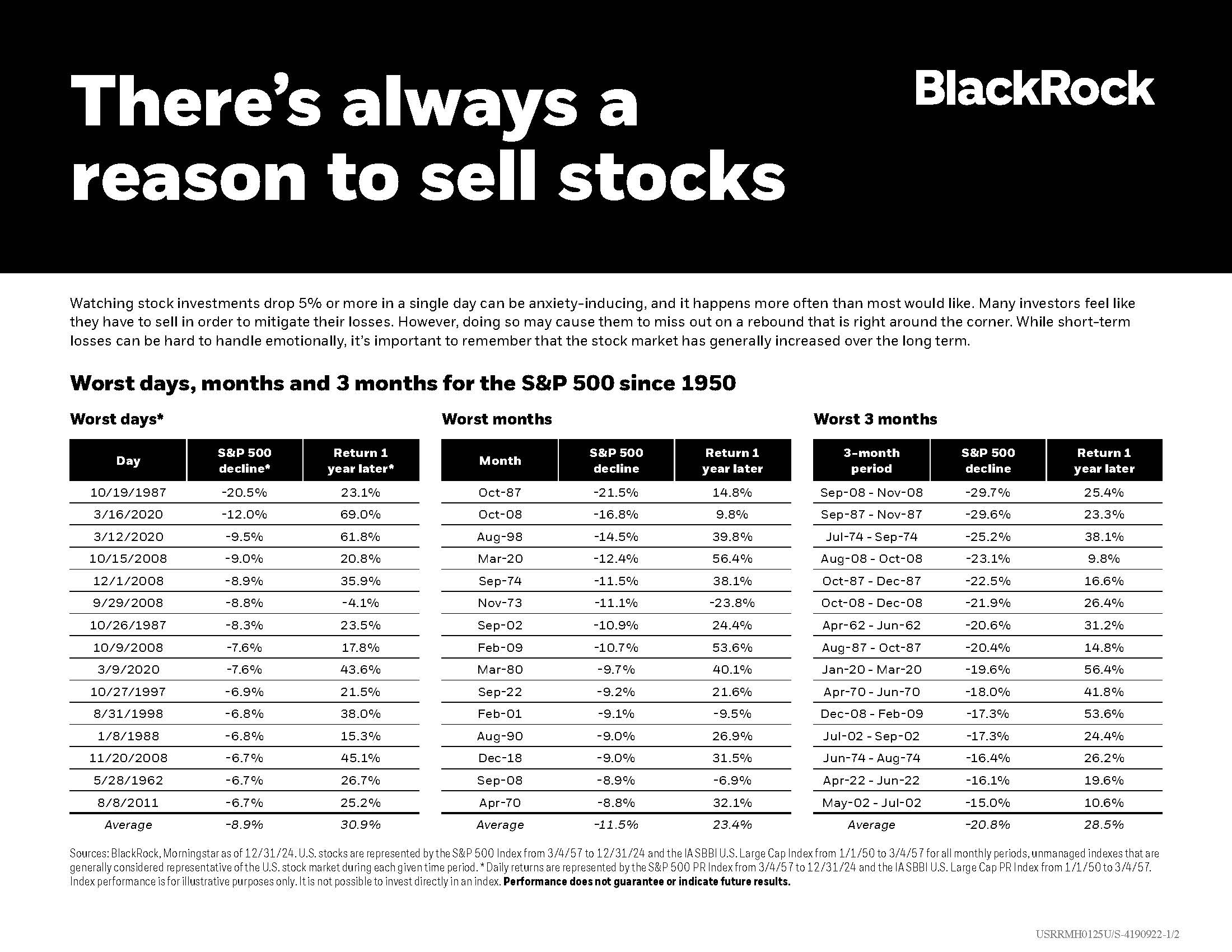

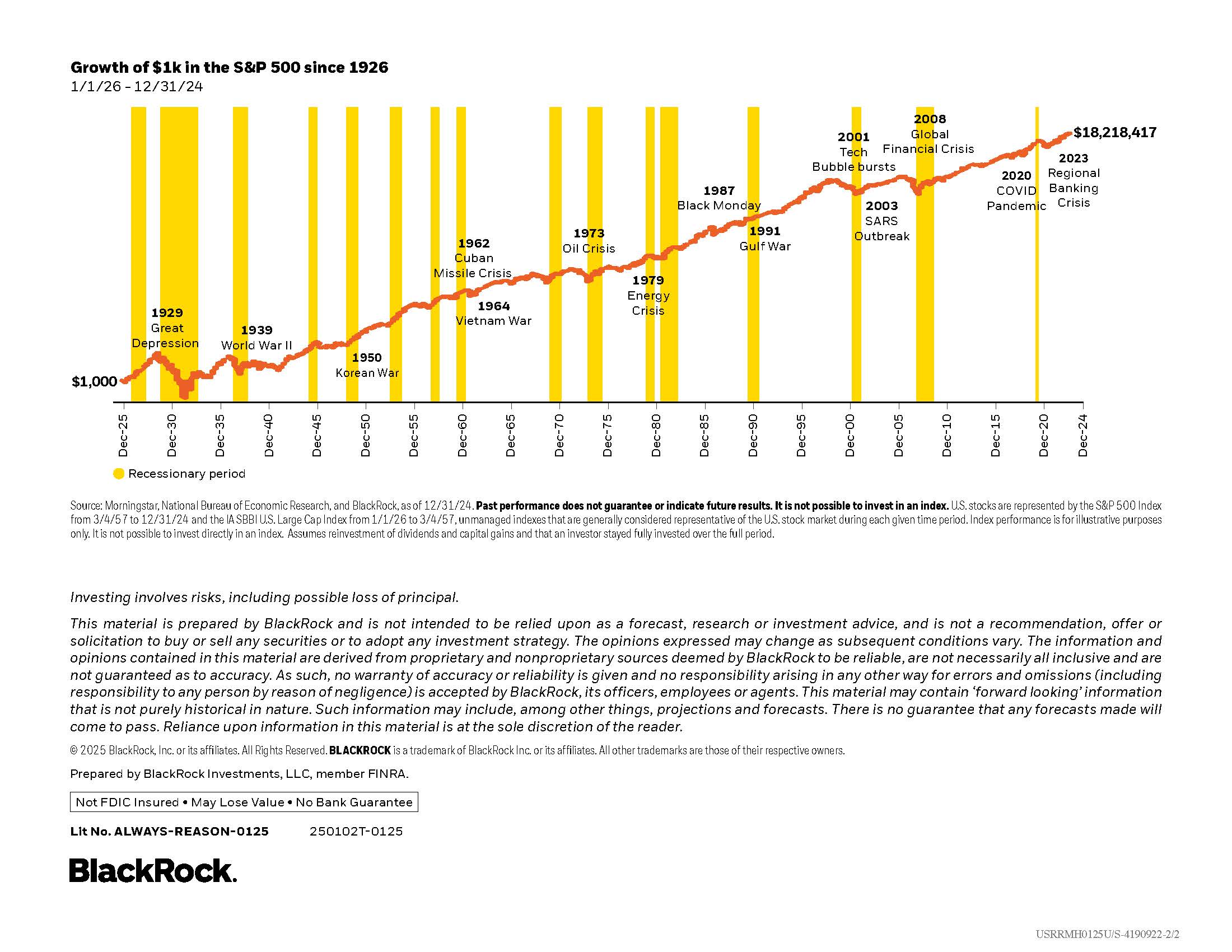

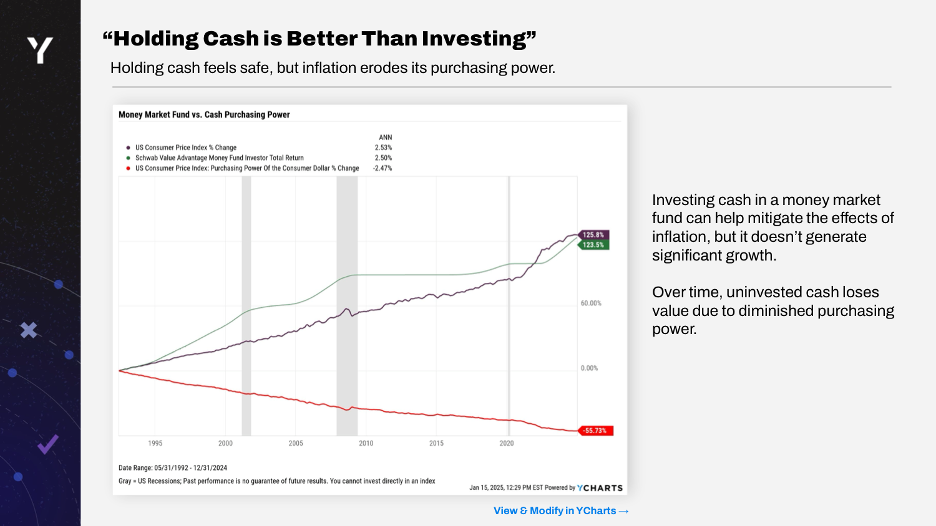

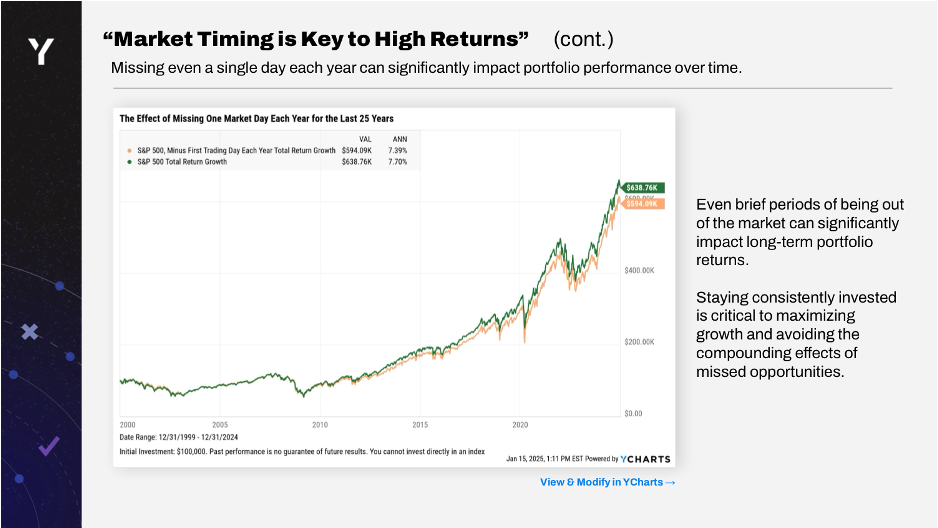

Periods of uncertainty and substantial market volatility are unsettling. With all the scary news headlines, it’s easy to imagine worst-case scenarios which could lead to emotional decisions that might derail a long-term financial plan. For perspective, it’s important to keep in mind that large drawdowns in the markets occur often on a surprisingly regular basis. Since 1980, the S&P 500 has experienced an average intra-year decline of 14% – even in years that ultimately ended in positive territory.* While no one can reliably forecast short-term market movements, history indicates that investors who remain invested during periods of volatility is one of the most reliable paths to long-term investment success.

In conclusion, below are a handful of charts that highlight the importance of staying invested over the long term.

If you have any additional questions or wish to discuss our investment outlook further, please contact my colleague Yoyo Chen to schedule a meeting with a member of Napier Financial Team. Yoyo’s contact information: ychen@napierfinancial.com; (781) 884-2315.

*source – LPL Financial

Link: https://grapevinesix.s3.amazonaws.com/pdf/pdf_fUm3s.pdf

Link: https://grapevinesix.s3.amazonaws.com/pdf/pdf_fUm3s.pdf