Your CPA is your go-to resource for taxes—they know the ins and outs of deductions, credits, and keeping unnecessary taxes at bay. But even the most skilled CPA is looking at one piece of the puzzle: your annual tax obligations.

Many of the potential clients we talk to have carried the responsibility of connecting their CPA to the rest of their financial world–investments, major decisions, cashflow, etc. This is an increasingly complex and consequential role as your balance sheet grows.

If you’re a client of ours, you’ve heard us over-emphasize the role of collaboration between your advisor and your CPA. It’s our job to help you ask the right questions to give your CPA the context–if not dialogue directly with your CPA. A few examples of what we’re looking for to help your planning:

- Understanding the structure of your investment strategy, especially as it relates to income

- Anticipating likely future changes–retirement, liquidity events, cashflow needs, etc.

- Communicating complex financial structures, especially regarding trusts

- Mobilizing tax planning strategies in real time on your balance sheet

It’s also worth noting that all of this collaboration should be happening throughout the year, not just before April 15th. Tax preparation is not tax planning. We don’t want our clients to find out what they owe when they have no opportunity to take action.

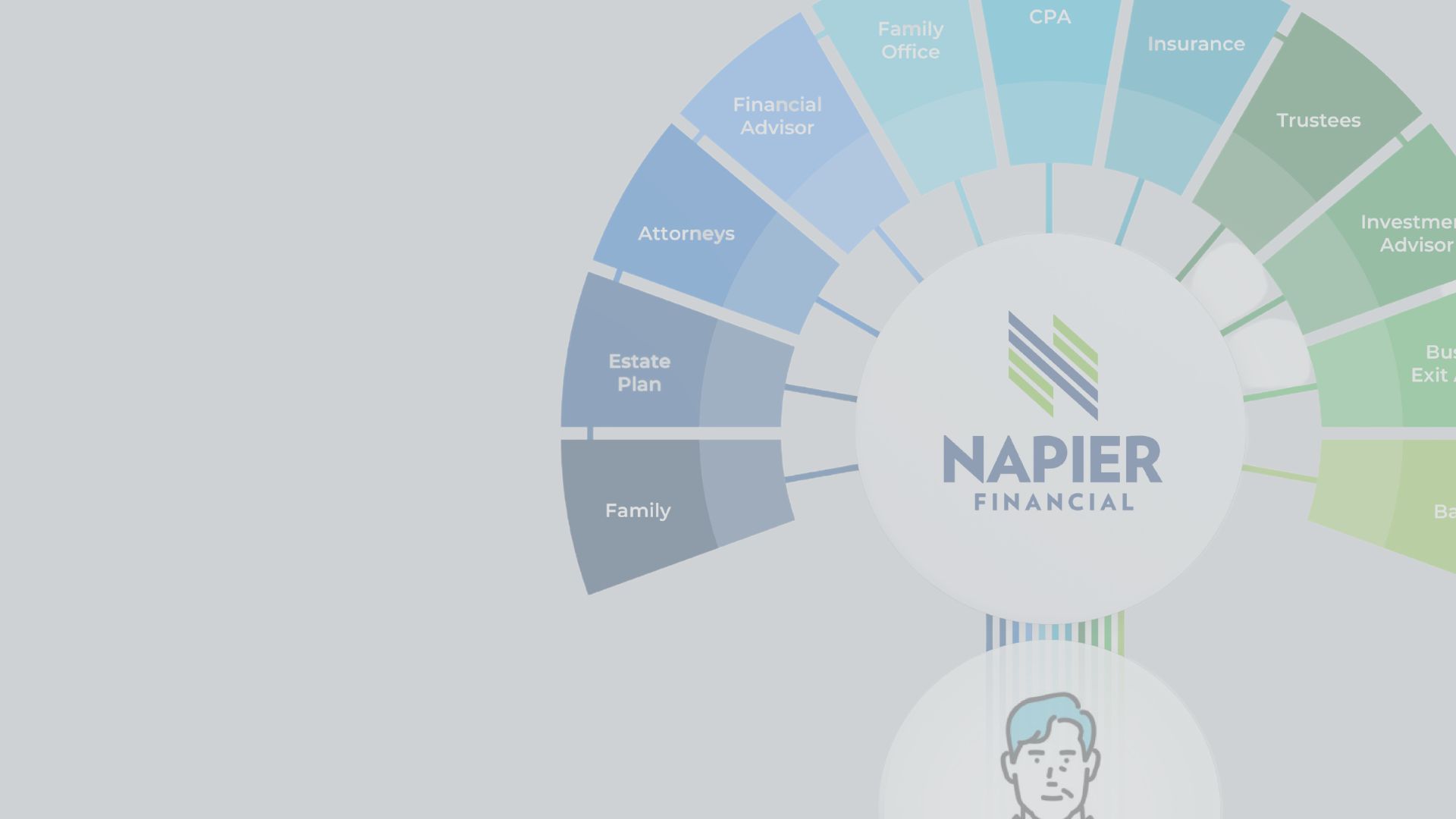

All of this to say, as we enter tax filing season, know that our team is fully engaged to assist with the process of collecting documents and collaborating with your tax planning professionals. Your financial plan, like your team, deserves to be fully integrated.