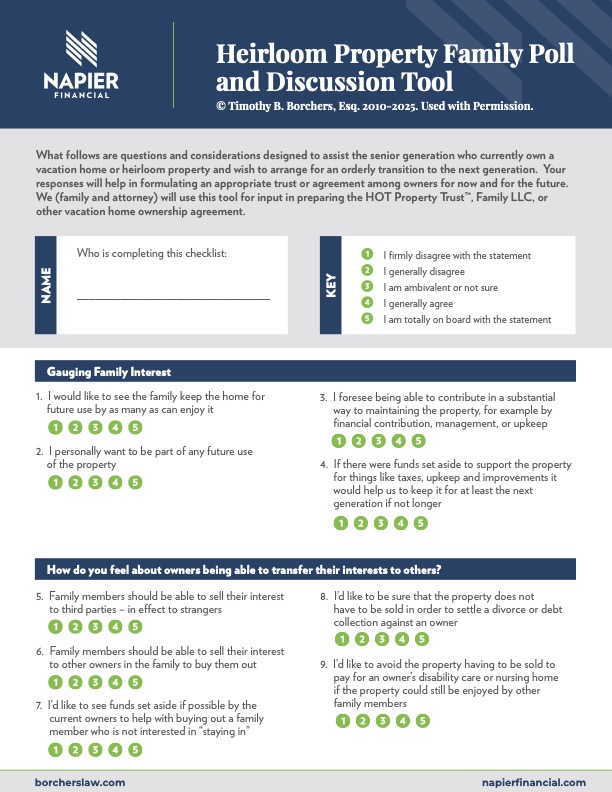

Family Legacy Properties

Setting future generations up for successful transfers

“We’d like to keep it in the family…”

Family property transitions are rarely straightforward. There are nuanced decisions about shared property ownership, inheritance, and long-term management that can impact your family for generations.

This Legacy Property Discussion Tool is the resource we use to help families navigate these complexities with clarity and confidence.

© Timothy B. Borchers, Esq. 2010-2025. Used with Permission. Learn more here.

"*" indicates required fields

Anticipate Problems

This questionnaire is the one we use to help our clients anticipate potential issues both financially and relationally. It addresses often-missed questions like:

- How will ownership be structured?

- What kind of trusts might be needed?

- How will taxes and maintenance be paid?

- Will we permit renting?

- What if one of our kids does not want to participate?

- What if some of my kids want to sell?

How We Use This Tool

Successful transfers are built on transparency and aligned expectations. To help accomplish this, we encourage:

- You take the assessment.

- Have your spouse or partner take it as well.

- Discuss your answers–identify any gaps in your expectations.

Once you have alignment with what you’d like to see, invite your inheritors to complete the questionnaire as well. Invite collaborative conversations around what each party expects.

Common Blindspots

Inheritors underestimate the cost of maintaining a vacation property (taxes, insurance, unexpected repairs, etc)

Siblings may not have equal access, proximity, or interest in the property.

Family members fail to set clear expectations for how what “fair usage” of a property looks like.

Lack of documented instruction often leads to “what mom and dad would have wanted” disagreements.

Set Your Family Up For Success

Use this questionnaire as a conversation starter to align expectations, think creatively, and ensure your property is a positive influence on the next generation’s unity.

"*" indicates required fields